Comparing funded accounts

Funded accounts can be very appealing. Who would not want to trade other people’s capital and still take home the larger part of the profits? But how do you navigate the vast landscape of funded accounts out there.

There are two decisions to make upfront: which instrument to trade and which platform to use. That narrows down the provider and prevents you from selecting a funded program that you cannot use. In my case, this is ES Mini’s (S&P 500 Mini Futures) and Ninjatrader.

I made a shortlist of 6 funded account programs that looked interesting and met my qualifying criteria. I went through all their online documentation and even spent time with their support to ask question on things that were not clear. Hopefully this might save you some time if you are looking for a funded account yourself.

I just wanted to point out that this is not sponsored content by any means. This is not a review yet. I will select one of them and sign up later. Be mindful that while compiling this information, I might have made mistakes or misunderstood the documentation. It is highly advised that you do your own research before signing up and trading with any of the programs.

I made sure to select the offering amongst them that was most similar so its easier to compare. In most cases, they have smaller and bigger accounts, but the overall rules are usually the same.

One thing to note is that they often change their offerings, so it is always worth checking if the details are still valid.

The list of funded accounts and their specific product that I will compare are

Oneup Trader – 50K account (90% split)

Topstep Trader – 50K account

Apex Trader Funding – 50K Full

Earn2Trade – The Gauntlet Mini 50K

Elite Trader Funding – 50K Eval (EOD Drawdown evaluations)

Take Profit Trader – 50K

Instrument Universe

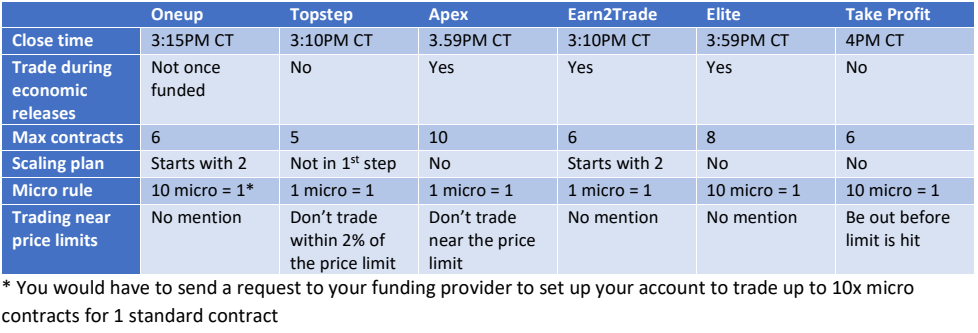

All programs offer a wider universe than just the ES Mini’s. For some it’s only futures but for others you can trade other instruments as well. You can check out their websites for those details. All of the offerings require you to close the contract at the end of the day. However, the exact time is different for all of them. Some of them also restrict you from trading through the major economic releases.

They all advertise the maximum number of contracts to trade. I have a few observations on this

- If your loss cannot exceed 1- or 2-thousand-dollar, trading more than 1 or 2 contracts (in the ES mini) is very risky.

- As you grow the (funded) account, and the limits loosen up, you will benefit from being able to scale your trading size.

- If you trade micro contracts (a tenth of the size of a mini), then the size limit might be much more important. Note that some platforms treat micro sizes as full sizes and others don’t.

- Some platforms make you start out with a smaller size and allow you to scale up as you become profitable. Refer to the details on their website if you want to know more about the scaling plan.

Fee structure

The data and exchange fees are included during the qualification period but be aware that some do charge these separately once you become funded.

Separate from all the fees, some platforms require you to have your own platform license. Most traders, like myself, probably already own a license to their platform so I did not research the detailed terms and conditions, especially because the terms seem to depend on the platform itself as well as the funded program. During the qualification phase all platform fees are included in the monthly fee.

Trading rules during qualification period

All but one of the programs under review have a 1 step qualification. This means that once you pass the qualification criteria, you become a funded trader. Topstep trader is the only one with a 2-step approach. You should really add both steps together in your assessment. I separated them out as 2 columns in the table below.

The treatment of the drawdown limit requires a few words of explanation. You can find a good explanation on each of the individual websites with good graphics.

- Trailing maximum drawdowns (TMD) are limits that are pegged to your positive account performance. Assume as an example that the drawdown starts with $2000 and your account starts with 50k. This means that you cannot let your account drop below 48k (Minimum account size) or you would fail the test. If you generate a profit of $1000, your new account value is 51K. However, the drawdown trails upwards with it, which means that your account now cannot go below 49k.

- The reference for the account value can either be determined at the end of the day or intraday. For intraday calculations, it can be done based on realised profits/losses or on unrealised profits/losses. The latter is the most restrictive and requires you to keep a very close eye on your balance at all times so you know what your limit is.

- For most funded accounts, the TMD stops trailing once the Minimum account size reaches your starting balance. Be mindful that Elite offers 2 different programs. One that has a trailing stop that has this fixture and one that does not. The one that continues to trail does not apply a daily loss limit and the one that stops trailing, has a daily loss limit. The monthly fees are slightly different for both offerings. For comparison, I included the one that stops trailing. Whichever one is selected determines the rules once the account becomes funded.

The consistency rules prevent you from making your target in 1 day and then do nothing anymore. That is not a valid test. This does not mean you fail the test, but it just shifts the target upwards. For example, if your best day cannot be more than 30% of your total profit and you make $2000 on one day, means you have to keep trading until you reach $6000 of profit.

Trading rules once funded

The rules are mostly similar than the qualification period, however not always identical. The rules around trading hours and contract sizes still apply as well.

For all but one platform all rules are explained in detail in the documentation page. Earn2Trade is vaguer as their funding partner will do an analysis on the performance and propose a funded plan which is more tailored to the trader.

Pay-out rules

The pay-out rules are probably the most complex and show the most variations between the programs. I tried to summarise the main attention points for comparison purpose.

All but one program requires you to accumulate a minimum amount before you can withdraw. In some cases, this buffer needs to remain in the account until you close out (or fail the account).

Last warnings before you sign up to any of those programs. Check if the rules are still the same and make sure you select one that works for your trading system and personality.

Good luck.